michigan property tax rates 2020

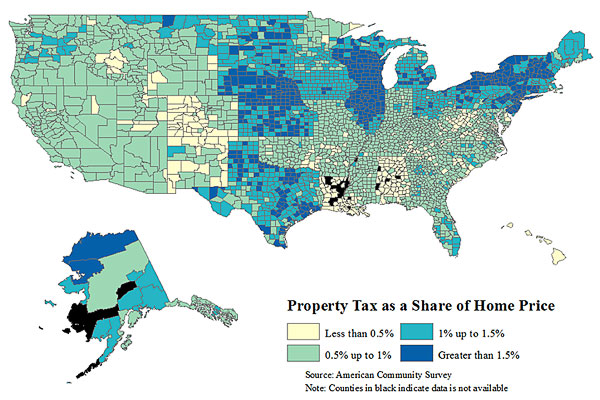

In 2020 Michigan will have the 13th highest property taxes an effective property tax rate of 144. Rates also include special.

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

On March 1 all unpaid.

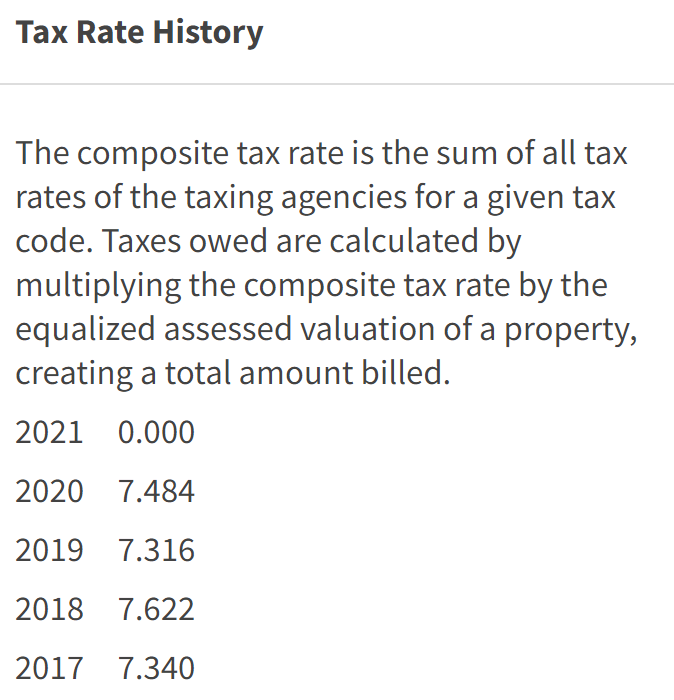

. There has been a significant reduction nearly halving the amount. 2017 Millage Rates - A Complete List. 2020 allocated tax rates county.

But rates vary from county to county. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. 162 of home value.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. Rates include special assessments levied on a millage basis and levied in all of a township city or village. In fact tax rates mustnt be increased before the general public is first alerted to that aim.

Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 245800 425800 185800. Total Millage for Principal Residence School District or Ag Exemption Total Millage NonHomestead Total Millage for Principle Residence or Ag Exemption Total Millage. What is Michigan income tax rate 2020.

2016 Millage Rates - A Complete List. Statewide the median home. 2020 Millage Rates - A Complete List.

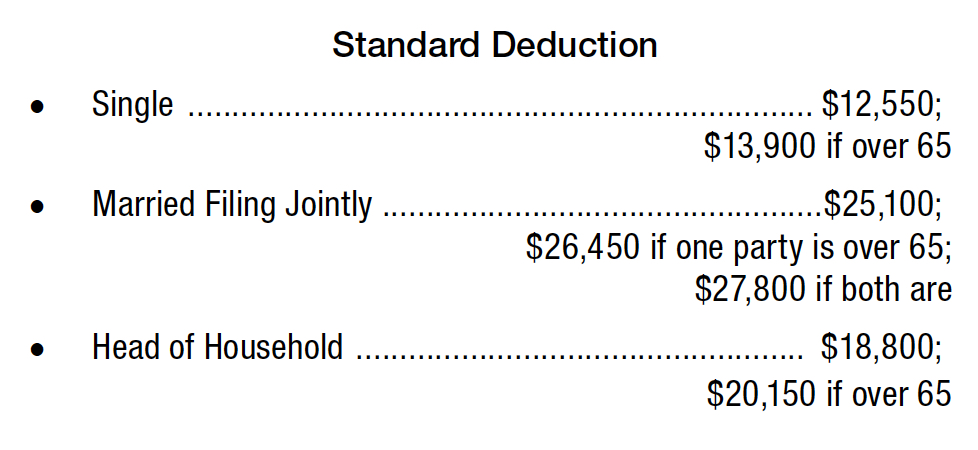

For Tax Year 2020 Michigan was taxed at the same flat tax rate of 425 within all levels of income. Winter Tax Rates. 2021 winter taxes are payable from December 1 through February 14 2022 without penalty.

Personal Property Tax classified 251 up to 12 mills School Operating. Are you wondering What is the average Michigan property tax rate Michigans effective real property tax rate is 164. Michigan local governments are heavily dependent on the property tax and the state levies a property tax as well.

Rates include the 1 property tax administration fee. 2018 Millage Rates - A Complete List. 2019 Millage Rates - A Complete List.

The Great Lake States average effective property tax rate is 145 well above the national average of 107. Detailed Michigan state income tax rates and brackets are available on this page. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOO 334884 514884 274884 394884 334884.

Then a public hearing on any proposed increase must be held before it occurs. Hawaii has the lowest effective. The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022.

After February 14 2022 a 3 late fee is assessed through February 28 2022. Personal Property Tax classified 351 up to 18 mills School Operating. Follow this link for information regarding the collection of.

Michigan has some of the highest property tax rates in the country. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. In fact there are two different.

For comparison purposes the average millage rate in Michigan was 42 mills and the average taxable value for residential properties was 58086. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465. Michigan Business Tax Exempt Special Notes.

Tax amount varies by county. The Tax Foundation ranked Michigan as having the 13th. Washtenaw County collects the highest property tax in Michigan levying an average of 391300 181 of median home value yearly in property taxes while Luce County has the lowest.

January 1 - December 31.

Cook County Property Tax Portal

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Sales Taxes In The United States Wikipedia

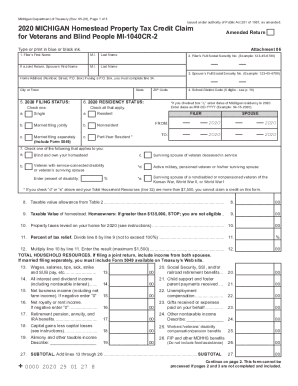

2020 Homestead Forms Fill Out And Sign Printable Pdf Template Signnow

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

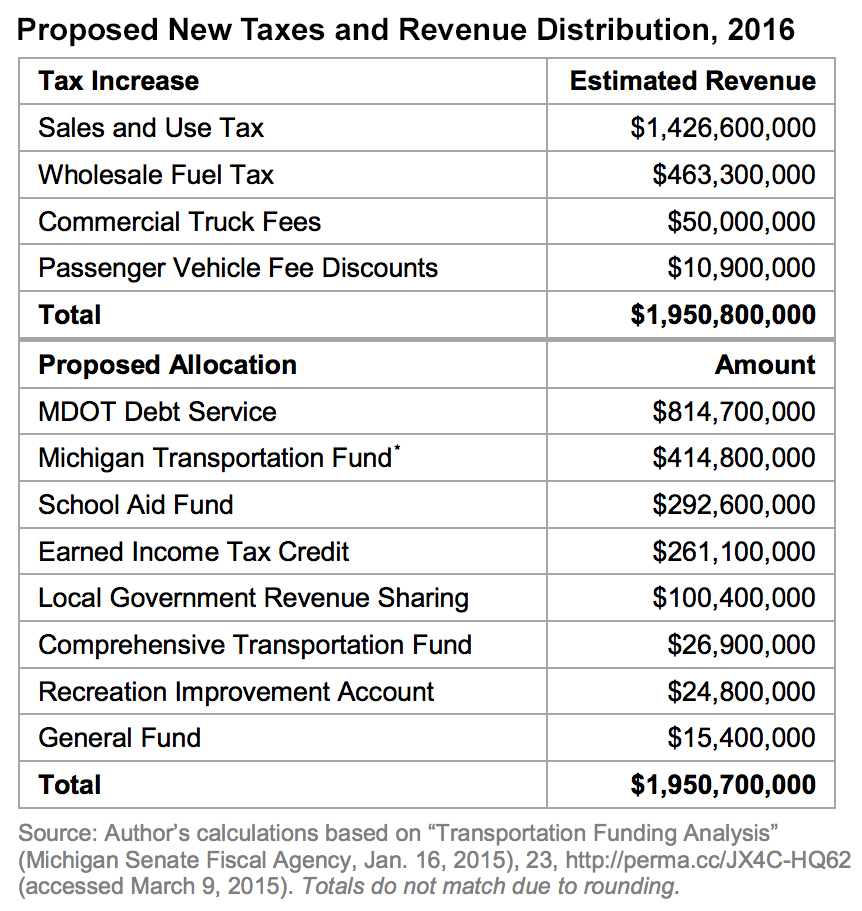

Michigan S May Tax Proposal Mackinac Center

2020 Michigan County Allocated Tax Rates Center For Local Government Finance Policy

Property Taxes How Much Are They In Different States Across The Us

State Individual Income Tax Rates And Brackets Tax Foundation

Property Tax Calculator Estimator For Real Estate And Homes

Providing Detroiters Property Tax Relief To Spur Neighborhood Revitalization Citizens Research Council Of Michigan

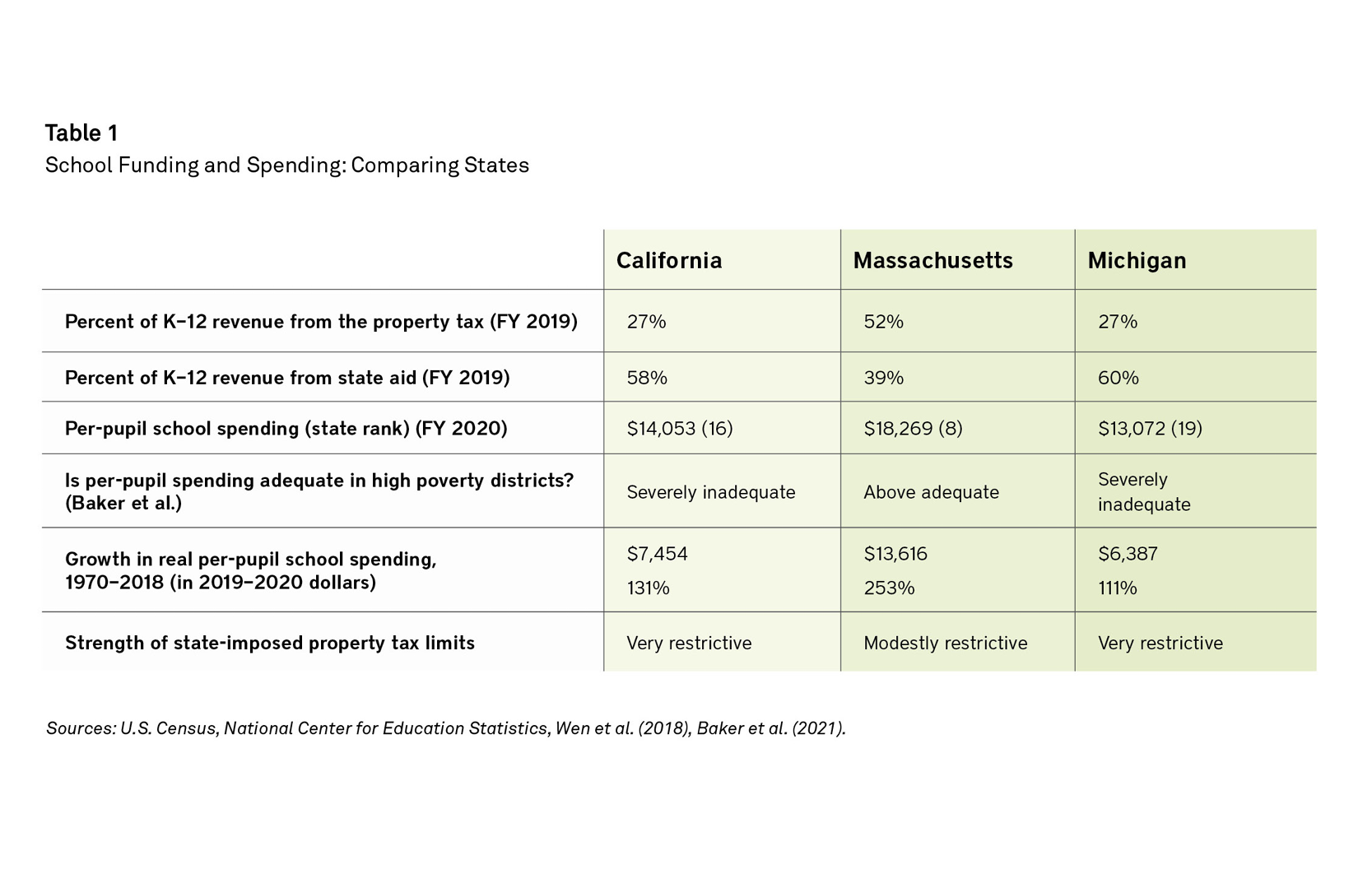

Public Schools And The Property Tax A Comparison Of Education Funding Models In Three U S States Lincoln Institute Of Land Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics